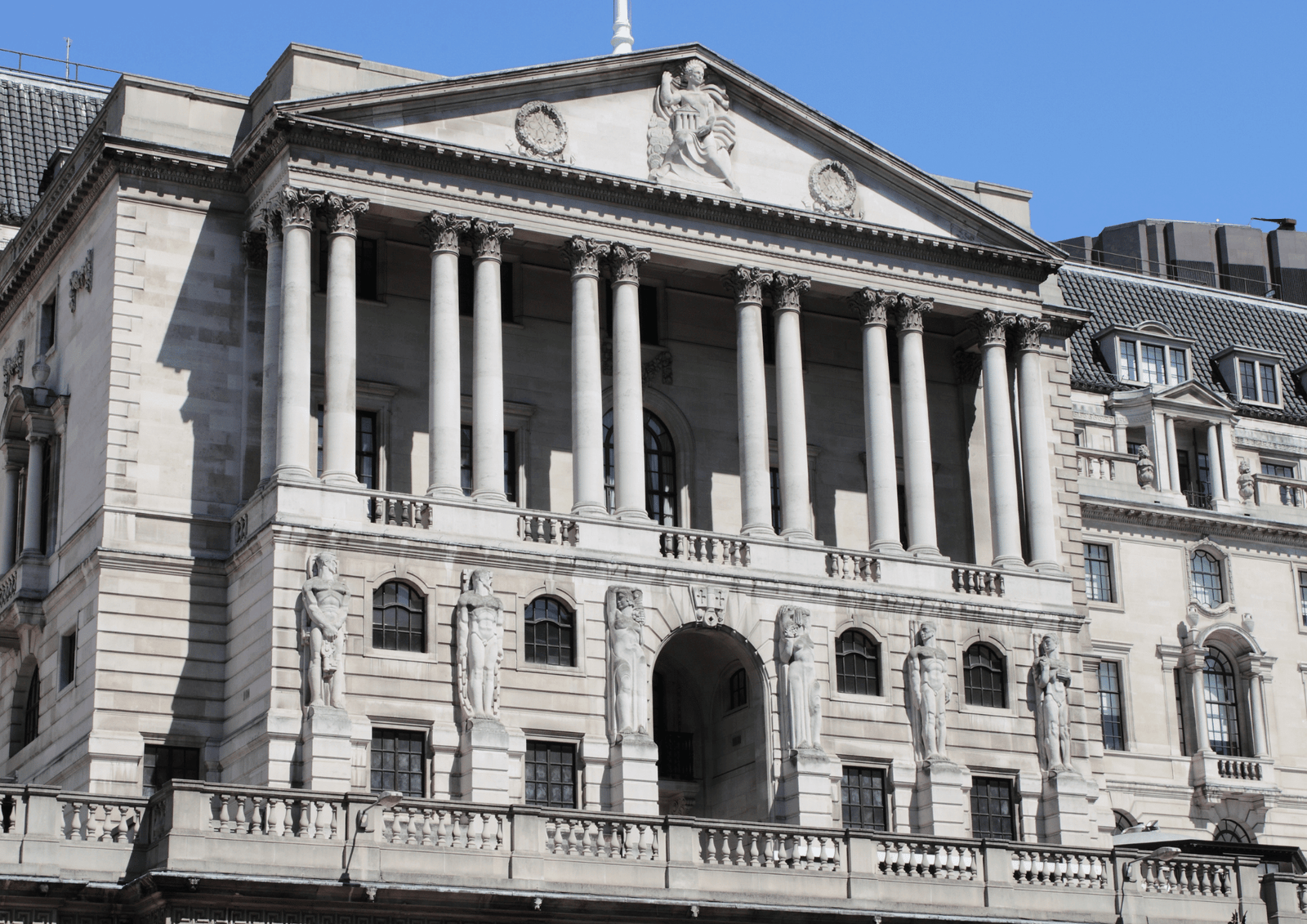

In a move that caught financial observers by surprise, the Bank of England (BoE) has announced a cut in its benchmark interest rate, dropping from 2.0% to 1.75%. This is the first time in over a year that the central bank has opted to ease its monetary stance, signaling a renewed commitment to spurring growth amid easing inflation pressures.

According to the BoE’s latest data, inflation—once nearing 5%—has gradually receded over the past few months, helped by more stable energy prices and an improved global supply chain. The Monetary Policy Committee (MPC) believes a modest cut will reinforce the current downward trend in inflation while encouraging spending.

Slowing Economic Momentum:

After a strong recovery period in late 2024, recent figures indicate the UK’s growth rate is leveling off. Policymakers decided that trimming the base rate could jumpstart investment and consumer purchases, especially in sectors like retail and manufacturing.

Central banks worldwide are revisiting their policies as global markets stabilize. The Federal Reserve in the United States and the European Central Bank have both hinted at more dovish approaches in the face of cooling inflation. This broader context likely informed the Bank of England’s decision, allowing it to move in step with international monetary trends.

Reduced from 2.0% to 1.75%, effective immediately.

Governor Andrew Bailey noted that the MPC will closely monitor economic indicators, leaving room for further adjustments if inflation creeps back up or if growth remains sluggish.

In remarks shared with the BBC, Bailey emphasized that while the BoE is “mindful of potential risks,” the overall direction of economic data supports a gentle easing of credit conditions.

Positive Stock Market Response:

London’s FTSE 100 saw gains in sectors such as finance, housing, and consumer goods. Investors generally welcomed the decision, interpreting it as a vote of confidence in the UK’s underlying economic resilience.

Mortgage and Loan Impact:

The immediate beneficiaries are likely homeowners on variable-rate mortgages, who could see a slight drop in monthly payments. Prospective homebuyers may also find more favorable terms, stimulating the housing market. However, savers might see a further dip in returns on their deposits.

Many economists view the cut as a balanced move that will spur borrowing and investment without triggering a fresh surge in inflation. However, some remain cautious, pointing to an unpredictable global geopolitical climate that could rattle energy and commodities markets.

Detractors argue that the BoE might be moving too quickly, especially if a sudden uptick in demand collides with supply constraints—potentially rekindling inflation. Others believe a more measured shift would have reduced the risk of market volatility.

Governor Bailey has pledged to revisit the rate decision in the coming months, underscoring the BoE’s dependence on real-time economic data. Factors like wage growth, core inflation, and global trade conditions will heavily influence the MPC’s future moves. If inflation remains on a downward path and growth improves, the Bank may opt to maintain or even lower rates further. Conversely, any unexpected resurgence in prices could see monetary tightening re-enter the discussion.

This rate cut underscores the Bank of England’s attempt to fine-tune the economy by making borrowing cheaper and encouraging businesses to expand. Homeowners with variable mortgages, prospective buyers, and companies seeking loans stand to benefit most. Savers, meanwhile, may need to explore alternative investment strategies to secure higher returns.

While the immediate outlook seems favorable for borrowers, the effectiveness of this move will hinge on the BoE’s careful management of any new inflationary pressures that might arise. With the central bank keeping a watchful eye on economic indicators, all eyes will be on upcoming inflation reports and growth figures to confirm whether this strategy is paying off.